eCommerce: Latin America

MercadoLibre: Marketplace, GMV & Sales Volume

MercadoLibre, a giant in Latin American online shopping, offers much more than just a marketplace. Discover how this company, leading in its home regions, is now rivaling Uber in worth. Dive into its impact on areas like fintech, logistics and payment.

Article by Cihan Uzunoglu | December 05, 2023

MercadoLibre: Key Takeaways

Rise to Dominance: Founded in 1999, MercadoLibre has diversified across Latin America and beyond, leading in global consumer-to-consumer app downloads and boasting a rising Gross Merchandise Volume.

Strongholds in Key Markets: The company's 2022 GMV is primarily anchored in Brazil, Argentina, and Mexico, with key product categories including Toys, Hobby & DIY, and Furniture & Appliances.

Fintech Revolution: In Q2 2023, fintech services contributed nearly 45% of MercadoLibre's revenue, showcasing its evolution beyond an online marketplace.

Growth Trends: While the firm's user numbers and sales continue to rise, the pace of its growth is moderating, indicating a potential period of stabilization.

Against Global Giants: Despite global competitors like Amazon and AliExpress entering the Latin American market, MercadoLibre's local expertise maintains its leading position.

What if there was an eCommerce giant that not only dominates its home turf in Latin America but also poses a serious challenge to global players like Uber in market capitalization? Meet MercadoLibre, a company that has gone from selling goods out of its own inventory to revolutionizing digital payments, diversifying into financial services, and even dabbling in digital streaming.

From its founding in 1999 to its NASDAQ listing in 2007 and beyond, MercadoLibre has continuously adapted to seize emerging opportunities — ultimately becoming a force to be reckoned with on the global stage.

As we pull back the curtain on this eCommerce player, we'll explore how MercadoLibre is far more than a marketplace. Delving into its stronghold in key markets like Brazil, Argentina, and Mexico, and unpack the variety of products that populate its digital platform, this piece will also discover how the company has turned its gaze beyond retail, transforming itself into a formidable player in fintech and logistics.

Strap in for a comprehensive tour of a company that embodies the aspirational spirit and dynamism of Latin America's tech sector.

MercadoLibre’s Regional Expansion

Established in 1999, MercadoLibre has carved out a distinct space for itself in Latin America's online retail sector. Operating on a hybrid business model, the company sells goods both from its own inventory and via third-party sellers, while offering a wide array of products, from Electronics and Grocery items to Fashion, Care Products and Hobby & Leisure.

Initially launching operations in Brazil, Argentina, Mexico, and Uruguay, the company expanded into Ecuador, Chile, Venezuela, and Colombia in the early 2000s. It strengthened its Brazilian operations by acquiring iBazar Como in 2001 and introduced Mercado Pago, a digital payment platform, in 2003. We will elaborate further on that later.

As we reach the mid-2000s, the online marketplace continued its expansion. By 2006, MercadoLibre had also entered Costa Rica, Panama, and the Dominican Republic. After its NASDAQ listing in 2007, MercadoLibre moved into the automotive and real estate sectors by acquiring Tu Carro and Tuinmueble in 2008.

The company improved its logistics with the 2013 launch of Mercado Envíos and expanded its real estate holdings in 2014 with multiple acquisitions. MercadoLibre diversified further in 2017 by launching Mercado Credito, a financial services arm. This growth persisted into 2021, highlighted by a move to raise capital through the sale of shares, known as an equity offering, and the acquisition of Kangu, a Latin American logistics operator.

A Global Force: MercadoLibre Leads Global C2C Apps & Nears Uber in Market Cap

As a marketplace, MercadoLibre's dominance is clear not only in Latin America, but also globally. According to data from AppMagic, MercadoLibre is the leading consumer-to-consumer (C2C) app worldwide as of November 2022. With over 90 million downloads on the App Store and Google Play Store, the marketplace tripled its closest contender, Vinted, while dwarfing the likes of eBay and OLX.

Data published by GP Bullhound also shows that MercadoLibre has the second highest market cap (US$42.56 billion) among the leading online marketplaces worldwide as of December 2022, behind Uber (US$49.32 billion).

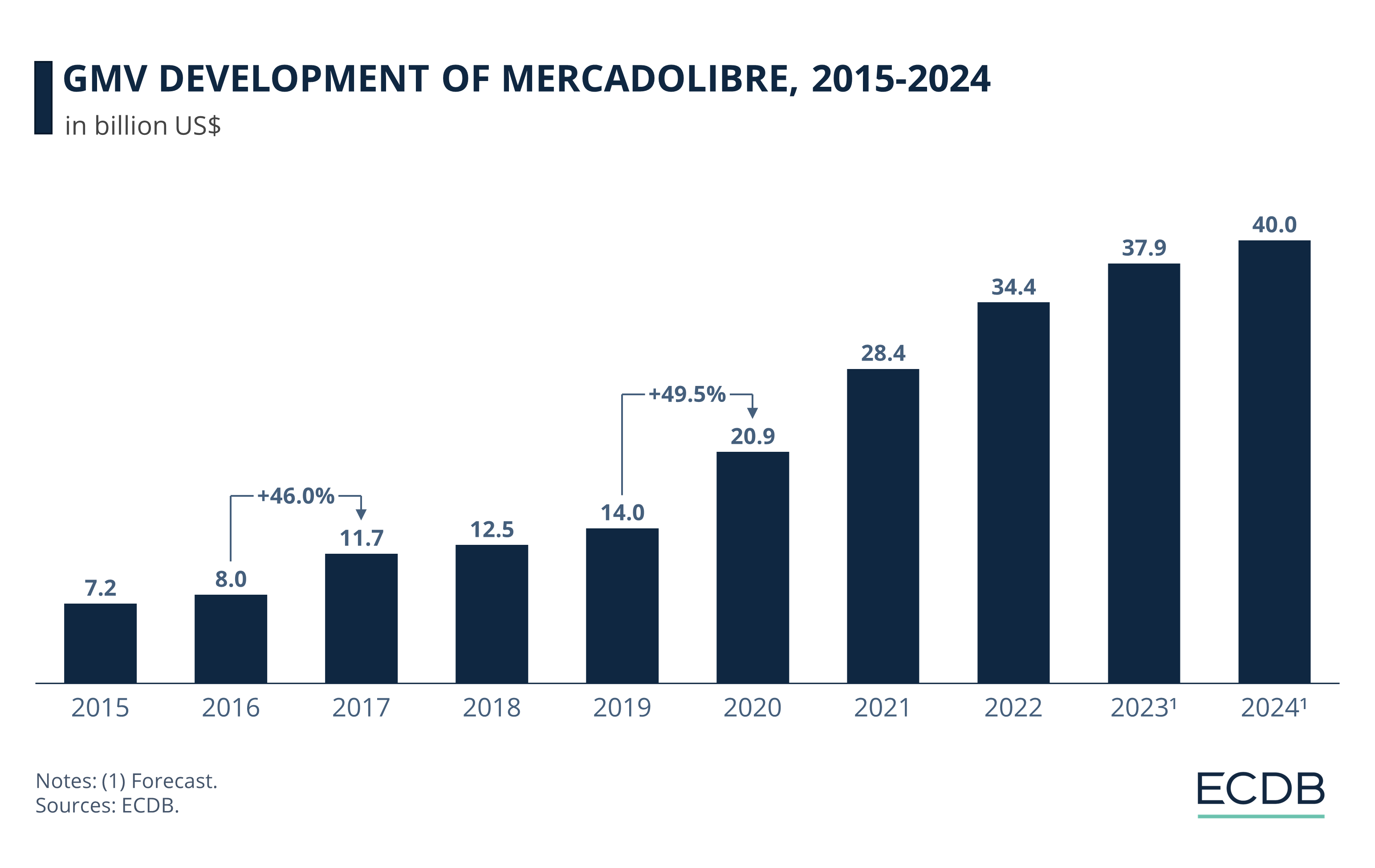

On that note, let's take a quick look at the development of MercadoLibre's Gross Merchandise Volume (GMV) to have a better understanding the company’s progress through the years.

In 2015, the marketplace GMV stood at US$7.2 billion, which climbed to US$8 billion in 2016. The subsequent year, 2017, marked a notable surge, growing to US$11.7 billion — a 46% growth compared to the previous year. This jump in growth would be followed by an even greater increase in the coming years.

While the GMV generally trended upward in the subsequent years, reaching US$14 billion in 2019, the year 2020 brought another substantial increase, catapulting the figure to US$20.9 billion at a 49.5% growth rate.

Fast-forward to last year, the GMV had further escalated to US$34.4 billion, reflecting the platform's expanding market clout. A forecast for this year projects an even higher GMV of US$37.9 billion, indicating that the upward momentum for the online marketplace is expected to continue.

MercadoLibre GMV Strongly Concentrated in Brazil, Argentina, and Mexico

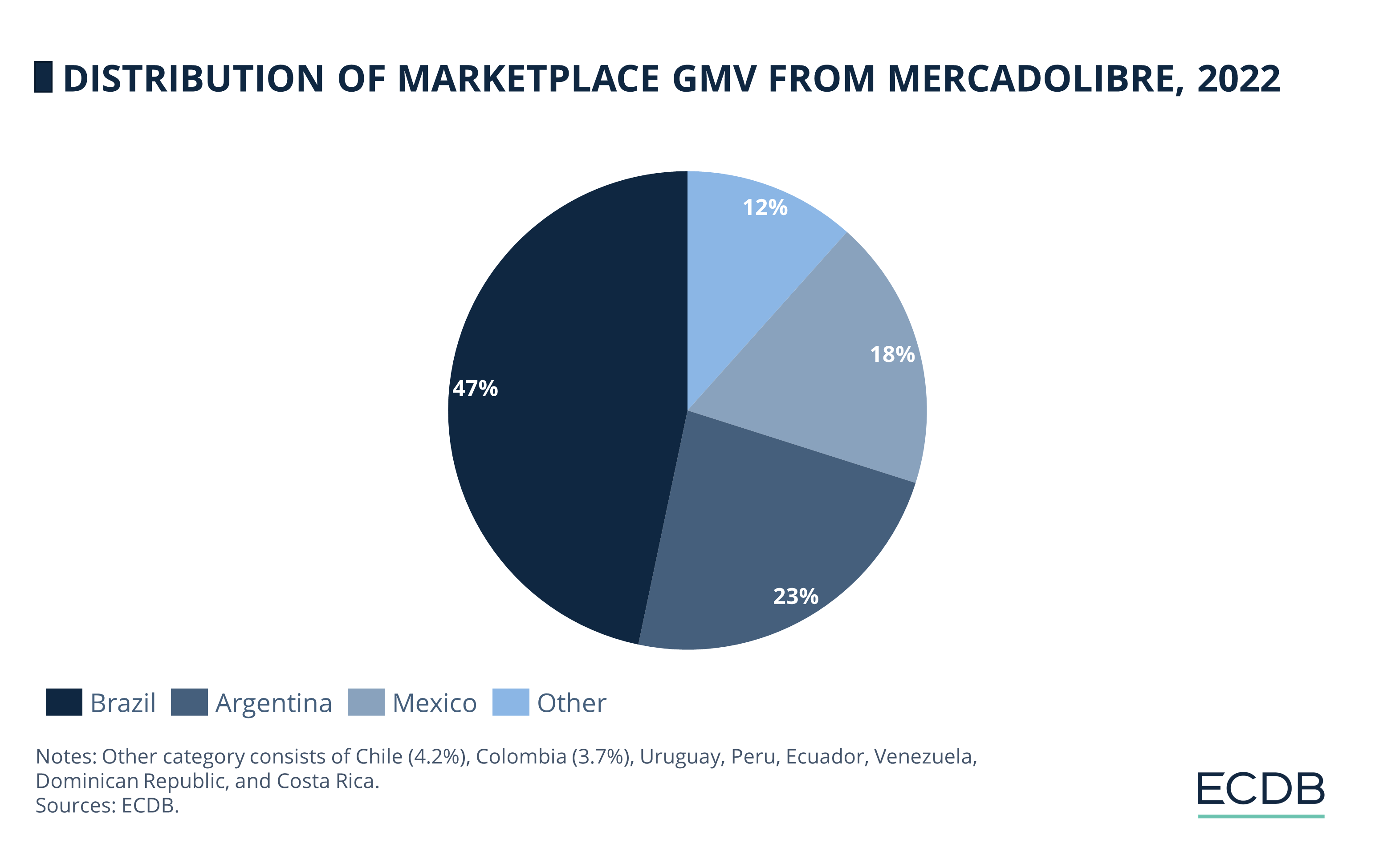

As hinted at earlier, MercadoLibre's distribution of 2022 GMV reveals a strong focus on key markets, particularly emphasizing the company's commanding presence in Brazil, Argentina, and Mexico.

A closer look reveals that Brazil leads with approximately 47% of the marketplace's GMV, while Argentina comes in second at about 23%. Mexico also holds a significant position, contributing nearly 18% to the GMV. Meanwhile, Chile and Colombia show moderate activity, generating 4.2% and 3.7% respectively.

Countries with smaller shares — namely Uruguay, Peru, Ecuador, Dominican Republic, Venezuela, and Costa Rica — are not dominant but remain part of MercadoLibre's diverse geographic landscape.

Top MercadoLibre Product Categories: Electronics, Grocery & Fashion

The breakdown by country offers a nuanced look at MercadoLibre's influence in individual markets. Yet, that's just one dimension. To complete the portrait, one ought to consider the variety of products that populate this bustling digital space.

According to our data, Electronics lead the way, making up 25.7% of the marketplace GMV. Grocery items are also significant, comprising 19.4% of the GMV. Fashion is another key category, representing 13.9%, while Care Products account for 11.7%. The DIY category closely follows at 11.5%, and Hobby & Leisure items represent 11.3% of the GMV. Finally, Furniture & Homeware has a share of 6.5% of the GMV.

More Than a Marketplace

Given its extensive product offerings, one might imagine that MercadoLibre would be content focusing solely on eCommerce. However, the company's ambitions stretch far beyond that, turning it into a fintech powerhouse in its own right.

Fintech Contributes Almost Half of Q2 2023 Revenue

MercadoLibre is not merely a marketplace; its pivot into financial services has transformed it into a formidable fintech player. Through Mercado Pago, its comprehensive financial arm, the company has established its own digital bank, launched credit card services, and offered payment terminals to businesses ranging from small enterprises to larger operations.

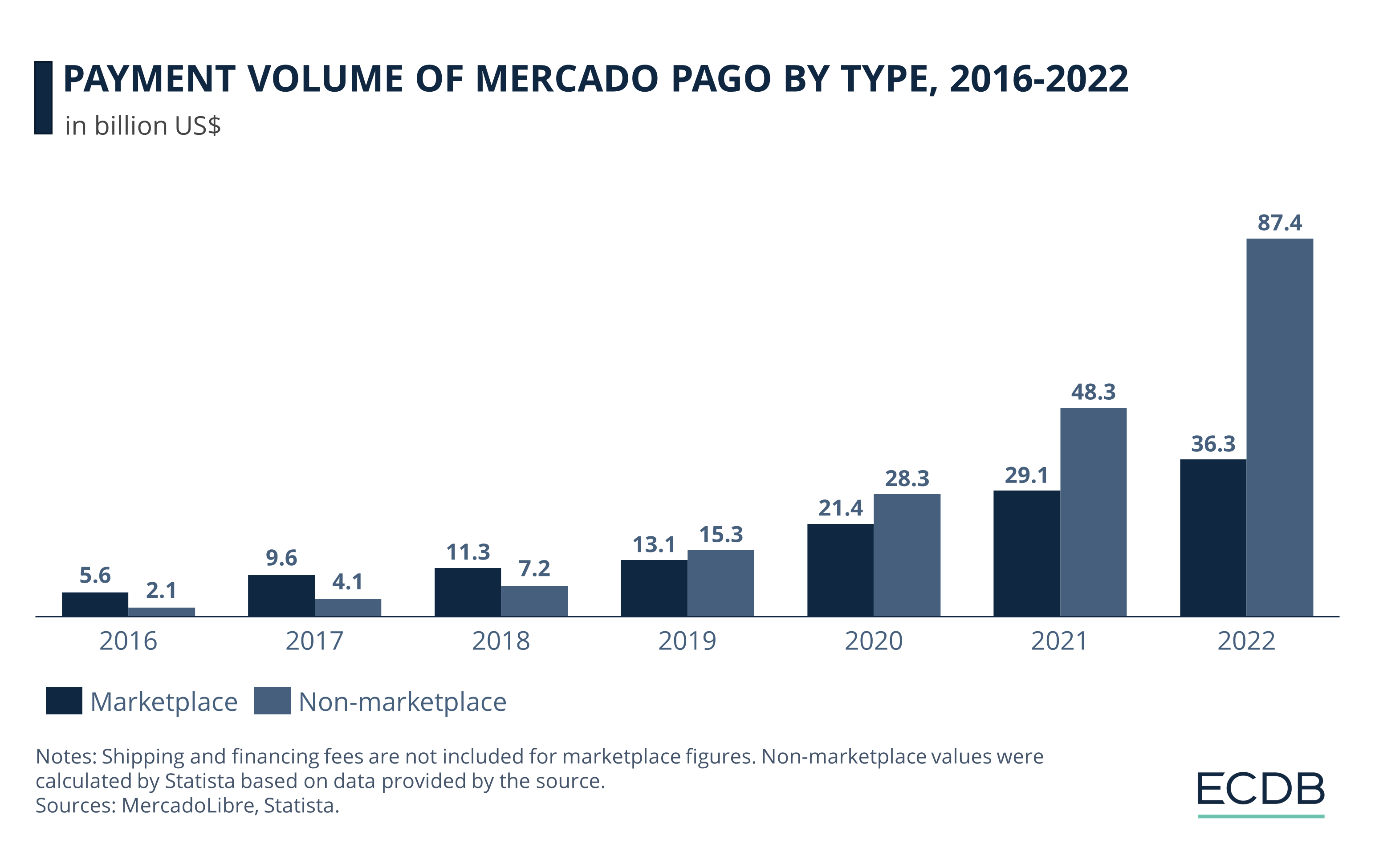

As of last year, this service has a footprint in countries including Argentina, Brazil, Chile, Colombia, Mexico, Peru, Uruguay, and Venezuela. The extent of Mercado Pago's reach is underscored by its financials – almost US$1.5 billion of the company's US$3.4 billion revenue for Q2 2023 emanated from this fintech offshoot, making up nearly 45% of the total.

Last year, the platform processed about US$48 billion in payments to external businesses, primarily small and medium-sized enterprises. This is aside from the roughly US$29 billion in transactions it facilitated on MercadoLibre's own marketplace. In the first half of 2023 alone, the total payment volume reached almost US$80 billion.

The user base of the payment service is also expanding. In the first half of this year, approximately 7 million new active fintech users were added, bringing the total count to 45.3 million. Much of this surge is attributed to increased adoption in Brazil, facilitated by high-yield savings accounts.

For the Q2 2023 period, it should also be noted that the company stated a slight deceleration in the breakneck growth it had previously experienced. Moreover, Mercado Pago has cautiously curtailed new loans, particularly as inflationary pressures mount in the region, showing the company's financial prudence in a fluctuating economic landscape.

MercadoLibre’s Streaming Efforts

As MercadoLibre broadens its focus beyond retail, financial services, and into new consumer territories, its pursuit of diversification becomes even more pronounced. The most recent additions to its sprawling offerings are Mercado Play, its digital streaming service, and Meli+, an expansive subscription program.

Available in Mexico and Brazil so far, Meli+ lets subscribers amplify both their shopping and entertainment experiences. Not only does the program offer perks like free shipping and scheduled deliveries, but it also provides access and discounts to various streaming platforms, including its own, Mercado Play.

Enhanced Logistics, Speedier Deliveries

Another space MercadoLibre is making significant strides in is the logistics sector, focusing on speedier delivery times that outpace its competitors. The company has even gone so far as to open new distribution facilities aimed at enabling same-day deliveries in key metropolitan regions.

Last year, Mercado Envíos, the firm's dedicated shipping arm, transported more than 1.1 billion goods — a substantial leap from the 151 million articles conveyed in 2017. As of last year, this logistics service extended its reach to countries including Argentina, Brazil, Chile, Colombia, Mexico, Uruguay, and Venezuela.

The trajectory of MercadoLibre's growth, though still robust, hints at a potential new phase in its evolution. This context serves as fertile ground for examining the competitive landscape, as other players in the eCommerce sector also look to expand their foothold in Latin America.

Looking into MercadoLibre’s Future

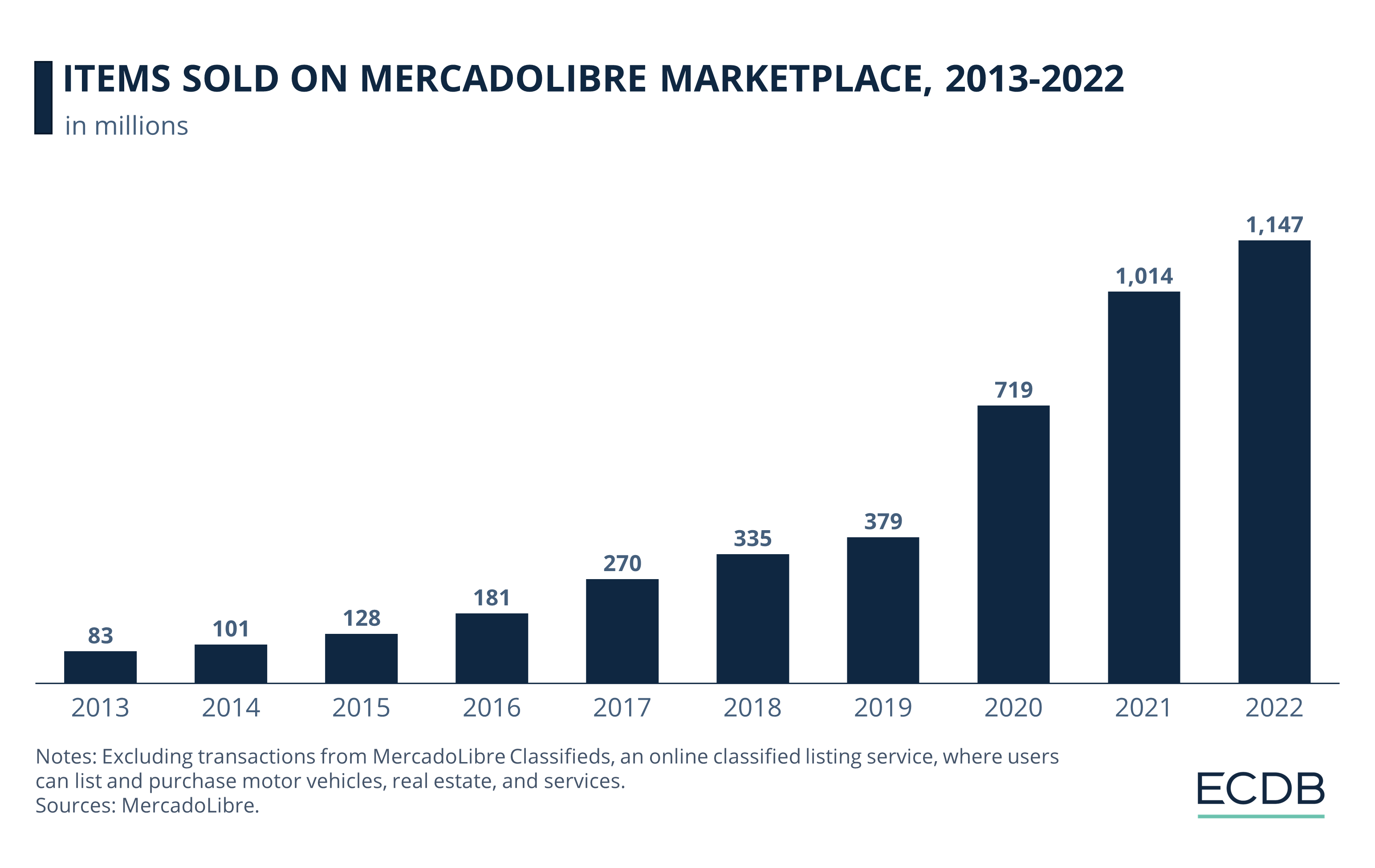

Up until 2019, MercadoLibre enjoyed a steady uptick in the volume of items sold. That year, the marketplace transacted a total of 378.9 million items, a figure that would soar to 719.3 million in the next year — a near 90% increase, illustrating the pandemic-fueled boom in eCommerce. This surge was also reflected in the base of active unique users, which almost doubled from 74 million in 2019 to 133 million in 2020.

Moving on, sales persisted on an upward trajectory in 2021, with a record 1.01 billion items sold and a further swelling of the active unique user base to 140 million. Yet, it's important to note that the meteoric growth rates seen in 2020 and 2021 appear to have tapered off last year.

While the platform did register an increase in sales to 1.14 billion items in 2022 and a modest rise in unique active users to 148 million, the rate of growth moderated relative to prior years. This indicates that, although the marketplace maintains its expansion, the velocity at which it is growing may be entering a period of stabilization.

While MercadoLibre has become synonymous with online retail and fintech in Latin America, it certainly doesn't operate in a vacuum. Amazon and AliExpress, as global entities, bring their own flavors of competition and strategy to the mix. It’s important to look at these challengers to fully appreciate the unique position MercadoLibre occupies in the region.

Amazon Trails MercadoLibre in Regional Influence

Latin America’s eCommerce market is a booming one with a promising future. Per projections from Statista's Digital Market Outlook, the number of eCommerce users in Latin America hit around 312 million in 2022. This tally is set to climb 25% by 2027, amounting to roughly 391 million users in the region.

Of course, big names in retail are taking notice of this, too.

In Latin America, Amazon holds a formidable yet secondary position in the eCommerce sphere when juxtaposed with MercadoLibre. Despite racking up 92 million monthly visits in Brazil and 73 million in Mexico, Amazon falls behind MercadoLibre, which garners nearly four times the web traffic in the region. Moreover, these metrics constitute a mere 3% of Amazon's global footprint — a far cry from its U.S. and European strongholds.

Amazon's foray into Latin America began in earnest with its expansion into Mexico in 2015, followed by a Brazil launch in 2017. The U.S.-based eCommerce leviathan has invested approximately US$3 billion in Mexico alone, aimed at bolstering its presence in the country's vibrant economy and taking on competitors like MercadoLibre and Walmart. The latest installment in this expansion strategy is a new delivery center in Mexico City, a sprawling facility that spans over 30,000 square meters and stands as Amazon's largest last-mile warehouse in Latin America.

The focus on Mexico is strategic: the country is home to about 40 Amazon warehouses and employs over 8,000 people directly while providing indirect employment to an additional 32,000. The Mexico City center is an extension of Amazon's broader strategy to locate distribution facilities closer to its customer base, particularly in populous urban areas; Mexico City alone has an estimated 22 million residents.

Amazon's Latin American strategy also includes Brazil, where the firm faces significant logistical challenges due to complex shipping regulations. Sellers from the U.S. and Canada can tap into these markets via Amazon's unified account system, although navigating Brazil's shipping environment requires special attention due to its complex and stringent shipping regulations.

Yet, Amazon's international reach has its limitations. Financial reports indicate that a mere quarter of Amazon's retail revenue is generated outside North America, a decline from approximately half in 2008. Despite strong competition in global markets such as the Middle East and India, Amazon has not been able to replicate its domestic retail success overseas.

However, it's worth noting that Amazon does maintain a robust global presence through Amazon Web Services (AWS), its cloud computing arm. In many Latin American circles, AWS is more recognized than Amazon's retail division, underscoring the challenges in scaling a logistics-heavy business model across diverse international markets.

AliExpress’ Latin America Front: Smart Logistics

While Amazon navigates a competitive landscape in Latin America, particularly against MercadoLibre, another global player is gaining ground in the region: AliExpress, the international arm of China's eCommerce giant Alibaba. Compared to Amazon, AliExpress has been executing a multi-faceted strategy to expand its footprint, especially in Brazil.

Founded in 2010 as Alibaba's gateway to international markets, AliExpress entered Brazil in 2013 when eCommerce was still nascent in the country. Over the years, the platform has honed various strategies to deepen its roots in Latin America. In 2021, AliExpress introduced a dedicated portal to support Brazilian small and medium-sized enterprises, a move that resonates with the local business ecosystem.

AliExpress's logistical ambitions are largely propelled by Cainiao, Alibaba's logistics subsidiary. Cainiao has been expanding aggressively in Latin America, setting up its regional headquarters in São Paulo, Brazil. The logistics arm plans to establish nine distribution centers in Brazil's key southeastern states over the next couple of years. In Mexico, a strategically located distribution center has been opened to reduce shipment times from China to just 12 business days.

Cainiao is not merely a courier for AliExpress; it is also venturing into providing local courier services. The logistics giant's network currently spans over 1,000 Brazilian cities, and it aims to expand this reach by adding 1,000 more lockers in 10 cities in Brazil. Similar to Amazon's focus on last-mile delivery, Cainiao seeks to place its logistics infrastructure closer to customers, albeit with a twist: the use of "smart lockers" that offer customers a convenient parcel pickup option.

While Amazon faces logistical challenges in Brazil due to complex shipping regulations, AliExpress and Cainiao seem to be capitalizing on their international logistics experience. Cainiao already operates eight weekly chartered flights between China and Brazil and aims to add more routes, signaling the company's commitment to streamlining its logistics efforts in the region.

Sources: AppMagic, GP Bullhound, Mercado Pago, MercadoLibre, Fintech Nexus, Investing, Fashion Network, Web Retailer, Reuters, World Population Review, EqualOcean, KrASIA, SiiLa, CNBC, TechCrunch, Statista, ECDB

Related insights

Article

Top Luxury Brands: Global Market Concentration, Trends & Online Net Sales

Top Luxury Brands: Global Market Concentration, Trends & Online Net Sales

Article

Chow Tai Fook: Strong Online Sales Growth

Chow Tai Fook: Strong Online Sales Growth

Article

Etsy: Revenue, Growth, GMV & User Statistics

Etsy: Revenue, Growth, GMV & User Statistics

Article

Who Is the Average walmart.com Shopper? Customer Base, Purchase Drivers & Consumer Insights

Who Is the Average walmart.com Shopper? Customer Base, Purchase Drivers & Consumer Insights

Article

Birkenstock Business Model: eCommerce Sales, Market Dynamics & Trends

Birkenstock Business Model: eCommerce Sales, Market Dynamics & Trends

Back to main topics